COMMUNITY FINANCIAL SYSTEM (CBU)·Q4 2025 Earnings Summary

Community Financial System Q4 2025: Revenue Beats but EPS Misses by a Penny

January 27, 2026 · by Fintool AI Agent

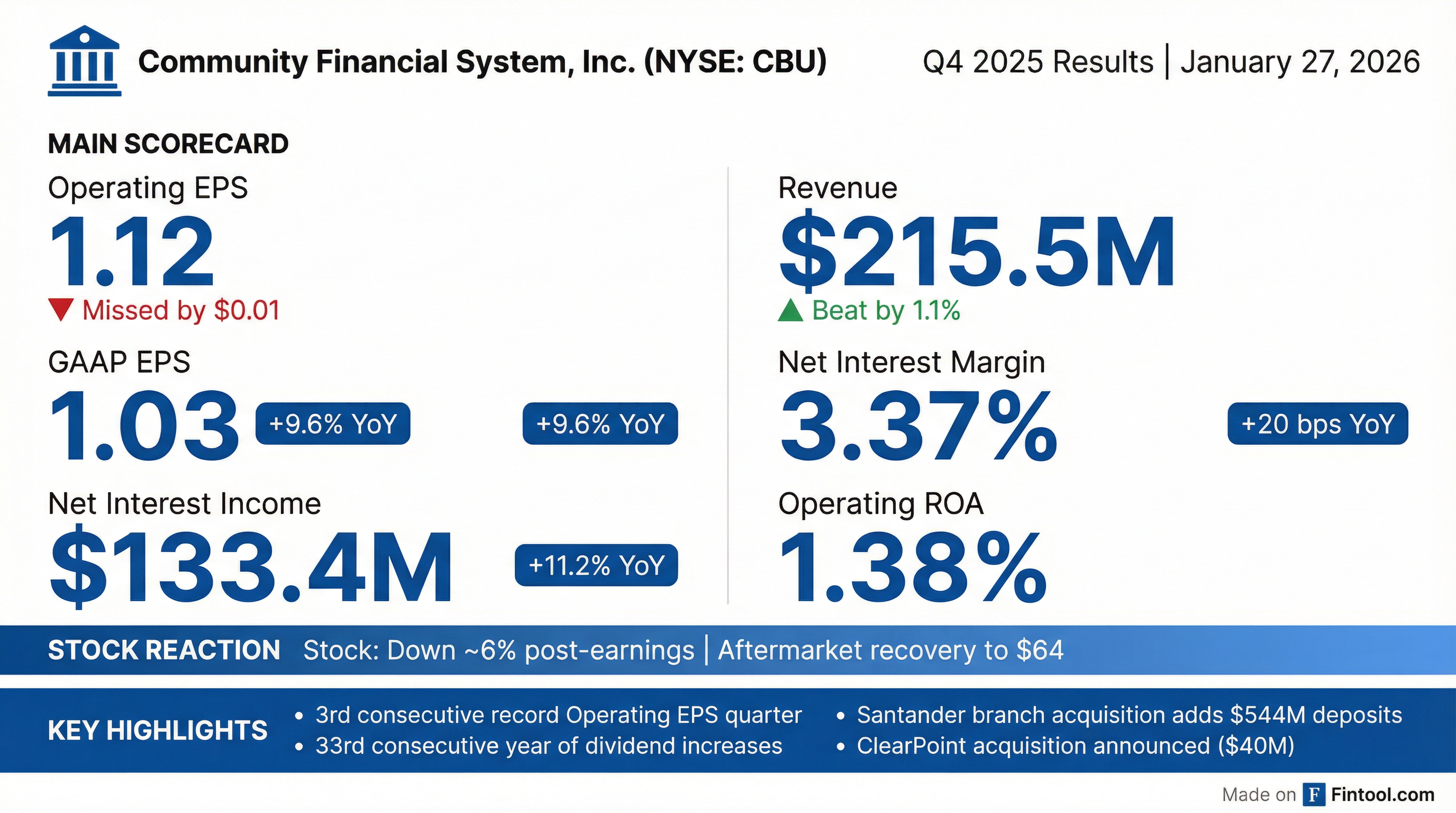

Community Financial System (NYSE: CBU) delivered its third consecutive quarter of record operating earnings, but a narrow EPS miss sent shares down roughly 6% in early trading before recovering in the aftermarket. The diversified regional bank reported operating EPS of $1.12 versus consensus of $1.13, while revenue of $215.5 million topped estimates by 1.1%.

The quarter featured strong execution across all four business segments, margin expansion in banking, and strategic moves including the completion of the Santander branch acquisition and announcement of the ClearPoint Federal Bank & Trust deal.

Did Community Financial System Beat Earnings?

The short answer: Mixed. Revenue beat, EPS narrowly missed.

The EPS miss appears driven by elevated acquisition expenses ($2.8 million) related to the Santander branch integration and higher performance-based incentive accruals. Excluding these items, core operating performance remained strong.

Year-over-year comparison:

What's Driving the Record Results?

Net Interest Margin Expansion

The standout metric was net interest margin, which expanded to 3.39% — up 20 basis points year-over-year and 6 basis points sequentially, marking the seventh consecutive quarter of net interest income expansion.

CEO Dimitar Karaivanov highlighted the drivers, noting the company was named 2025 Company of the Year in Banking by Buffalo Business First:

"Our Company continued its strong revenue performance across all businesses. Our quarterly operating diluted earnings per share result of $1.12 represents a third consecutive quarter of record results. This accomplishment was driven by margin expansion in our banking business along with increases in revenues and improvements in core operating performance in our employee benefit services and wealth management services businesses."

Margin drivers:

- Yield on earning assets rose to 4.60% (+8 bps YoY)

- Cost of interest-bearing liabilities fell to 1.68% (-16 bps YoY)

- Cost of funds declined to 1.27% (-6 bps from Q3)

- Average deposit costs remain low at 1.15%

Automation & Efficiency Gains

A notable disclosure on the call highlighted operational leverage from technology investments:

"Due to our focus on automation, we have saved over 200,000 hours over the past 3 years, and that has allowed us to keep our headcount roughly flat while growing the overall business meaningfully. We now need to see it fully in the bottom line."

Management flagged AI and automation as a key 2026 focus area for expense management.

Four Business Segments All Contributing

CBU's diversified model showed strength across all segments:

Pre-Tax Tangible Returns by Segment (Q4 2025):

Employee Benefits Turnaround

The segment breakdown within Employee Benefit Services tells a more nuanced story:

- Retirement side: Grew high single digits in 2025

- Institutional trust side: Flat YoY revenue, down slightly on pre-tax due to investment

- 2026 catalysts: 20+ fund launches in H1 2026, sitting at highest AUM ever

Management expects mid-to-high single digit growth in 2026 as the revamped trust fund administration strategy gains traction.

How Did the Stock React?

CBU shares dropped approximately 6% in early trading on the narrow EPS miss, but recovered in the aftermarket to around $64 — up from the regular session close of $61.77.

Context matters: The stock was trading near its 52-week high of $68.11 heading into earnings, creating a high bar for expectations. The current price represents:

- +4.5% above 50-day moving average ($59.13)

- +7.5% above 200-day moving average ($57.44)

- Market cap: ~$3.25 billion

What Changed From Last Quarter?

Strategic Moves Accelerating

Santander Branch Acquisition Completed (November 2025)

- 7 branch locations in the Lehigh Valley, Pennsylvania

- Added $543.7 million in deposits

- Accelerates de novo expansion strategy

ClearPoint Acquisition Announced (January 2026)

- $40 million all-cash transaction

- National leader in death care industry trust administration

- $1.5 billion AUM with 8.8% 3-year revenue CAGR

- Expected to close Q2 2026

De Novo Branch Progress

The 15 new branches opened in 2025 are tracking well:

Management noted branches typically take 18-24 months to mature, so the 2026 outlook is promising given most opened late in 2025.

Balance Sheet Strengthening

Notable: The 5% loan growth came despite >$300 million in commercial paydowns during 2025, demonstrating strong organic origination momentum. Q4 loan growth included ~$32M of acquired loans from the Santander branch acquisition.

Credit Quality: Stable Despite CRE Concerns

Management addressed the elephant in the room — commercial real estate exposure — directly:

Key points from the release:

- Non-owner occupied and multifamily CRE = 15% of total assets, 24% of total loans

- Portfolio is diverse both geographically and by property type

- Provision of $5.0 million reflects organic loan growth, not deterioration

- Loans 30-89 days delinquent increased 10 bps from Q3 — management noted this aligns with typical seasonal trends

What Did Management Guide?

Management provided detailed quantitative guidance for 2026 on the earnings call:

Tax headwind: Management noted that the New York State income tax rate is now ~2% higher than 18 months ago, creating an ongoing headwind the company is working through.

Q1 2026 NIM guidance: Management expects 2-4 basis points of NIM expansion in Q1, driven by loan repricing tailwinds and lower deposit costs.

Expense seasonality reminder: Q1 expenses typically run higher than Q4 due to merit increases, higher FICA/payroll taxes, and snow removal costs.

Analyst expectations (forward):

- Q1 2026 consensus EPS: $1.13

- FY 2026 consensus EPS: ~$4.70 (+12% YoY)

Q&A Highlights

Loan Pricing Trends (Steve Moss, Raymond James)

CEO Karaivanov noted Q4 loan originations were in the low sixes, with the trend clearly moving lower. However, the company still has significant fixed asset repricing runway:

"Fortunately for us, we have a lot of fixed asset repricing to continue. So if you look at kind of that low sixes compared to the current yields that we have on the loan portfolio, there's still a decent amount of gap for us to benefit from."

Fee Income Trajectory (David Konrad, KBW)

When asked about the 38% fee income ratio and whether it could expand, Karaivanov emphasized balance:

"We love all of our core businesses... We are experiencing right now in the banking business tailwinds on the margin side, which we haven't had historically. So even as the other businesses are doing really well themselves, it is hard to overrun the bank."

Management noted they complete 8-12 acquisitions annually, mostly in fee income businesses that don't make headlines individually.

ClearPoint Death Care Business (Matthew Breese, Stephens)

Karaivanov provided color on the niche trust administration business:

- Market dynamics: As death care costs increase, people increasingly save via trusts, insurance, or deposits depending on state regulations

- Competitive position: ClearPoint is one of a few leading players in a fragmented market

- Growth levers: Asset management cross-sell via Nottingham Advisors (8 CFAs, 3 CFPs, ~$10B AUM), dedicated escrow products, SBA financing for funeral homes

- Moat: State-by-state rules make it complicated to enter; nationwide presence is rare

Securities Book Repricing (Manuel Navas, Piper Sandler)

The securities repricing tailwind is not factored into 2026 guidance because the maturities are concentrated in late Q4 2026. Looking ahead:

- 2027: Another $600 million maturing, more evenly spread

- Deployment priority: Loans first, or offset long-term borrowings if loan demand is insufficient

Capital Return: 33 Years and Counting

The dividend story remains a core differentiator:

- Quarterly dividend: $0.47/share (+2.2% YoY)

- Annualized yield: ~3.0% at current prices

- Streak: 33rd consecutive year of dividend increases

- 2026 buyback: Board authorized repurchase of up to 2.63 million shares (5% of outstanding)

No shares were repurchased in Q4 2025.

Key Takeaways

-

The miss was technical, not fundamental. A $0.01 EPS miss driven by acquisition integration costs shouldn't obscure the third consecutive quarter of record operating results.

-

Margin expansion has legs. Management guided 2-4 bps NIM expansion in Q1 and 8-12% NII growth for FY26. Securities repricing in late 2026/2027 provides additional runway.

-

Diversification is working. All four business segments contributed, with employee benefits (61% pre-tax tangible return) and wealth management (39%) providing durable, fee-based revenue streams.

-

M&A pipeline is active. The Santander integration is complete, ClearPoint adds death care trust administration, and management noted they complete 8-12 deals annually across fee income businesses.

-

De novos ramping. 15 branches with $100M in footings (60% commercial), targeting $200M by year-end with a long-term goal of $1B+.

-

Automation paying off. 200,000 hours saved over 3 years keeping headcount flat while growing. AI and automation are 2026 priorities for expense leverage.

-

Credit remains benign. NCOs at 0.09%, NPLs at 0.52%, and well-reserved positions CBU favorably vs regional bank peers facing CRE stress.